Moneytree

Founded in 2012 as one of Japan's first personal finance apps, Moneytree grew to serve over 6.5 million users. Its Open Banking platform now connects to 2,500+ financial institutions and supports 120 enterprise customers.

I joined as a Senior Product Designer in 2016, and soon after was promoted to Product & Design Lead. I then rejoined in 2021 as Director of Design, eventually becoming Director of Discovery.

During this time I managed a team of product and brand designers, spearheaded the creation of a product for SMBs, and designed the core products of Moneytree's platform.

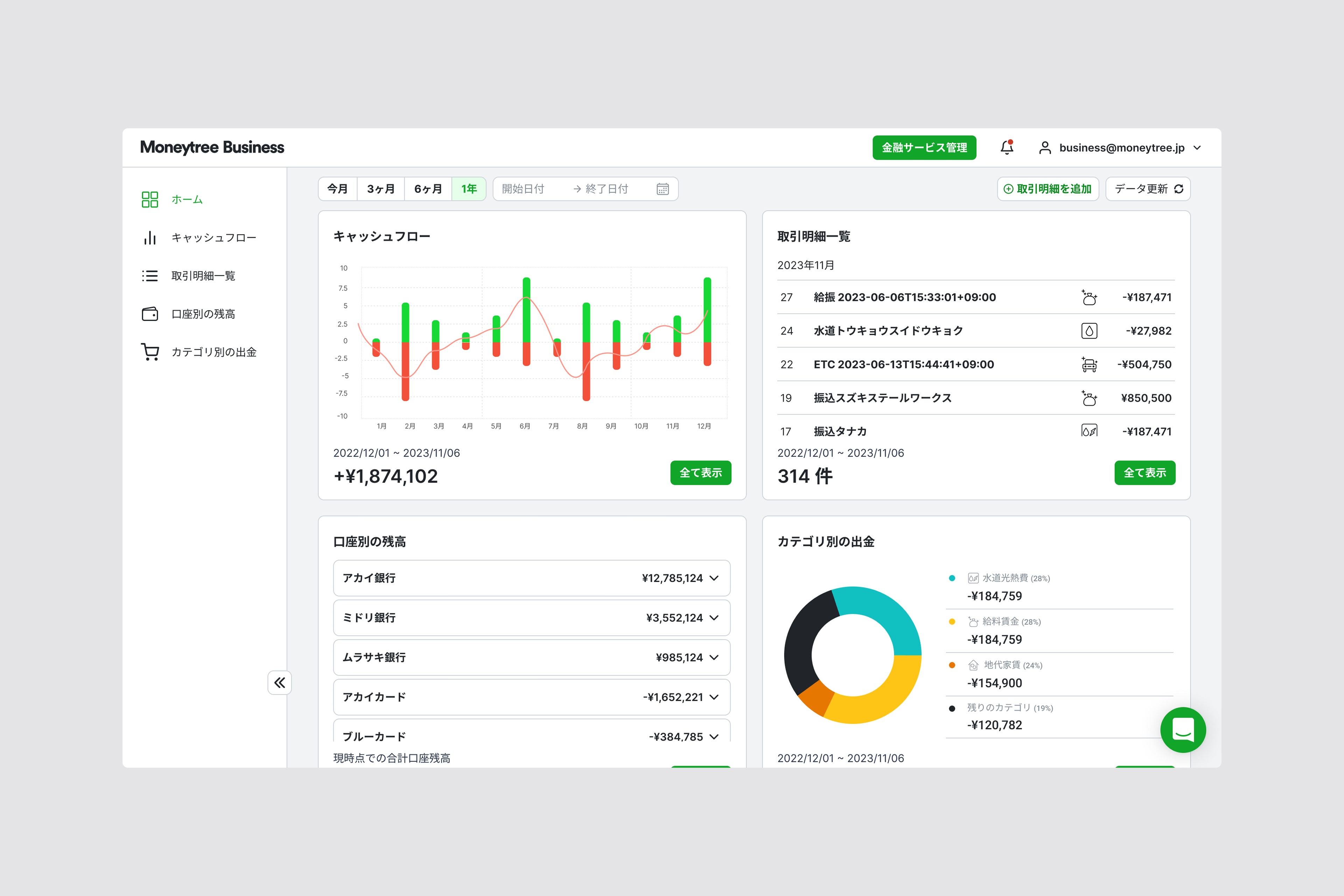

Moneytree Business

I assembled and led a product team through a six-month 0-1 process to create Moneytree Business. In my role as Director, I was accountable for the team's outcomes, whether creative, financial, or technical, and I also handled the common HR responsibilities around people management.

Through 20+ interviews with business owners, alongside market research to understand economic factors, we found a painful reality.

Businesses were drowning in manual financial tasks. Some spent over 30 hours per week visiting ATMs to confirm transactions and reconciling stacks of receipts by hand. All time that was taking away from growing their businesses.

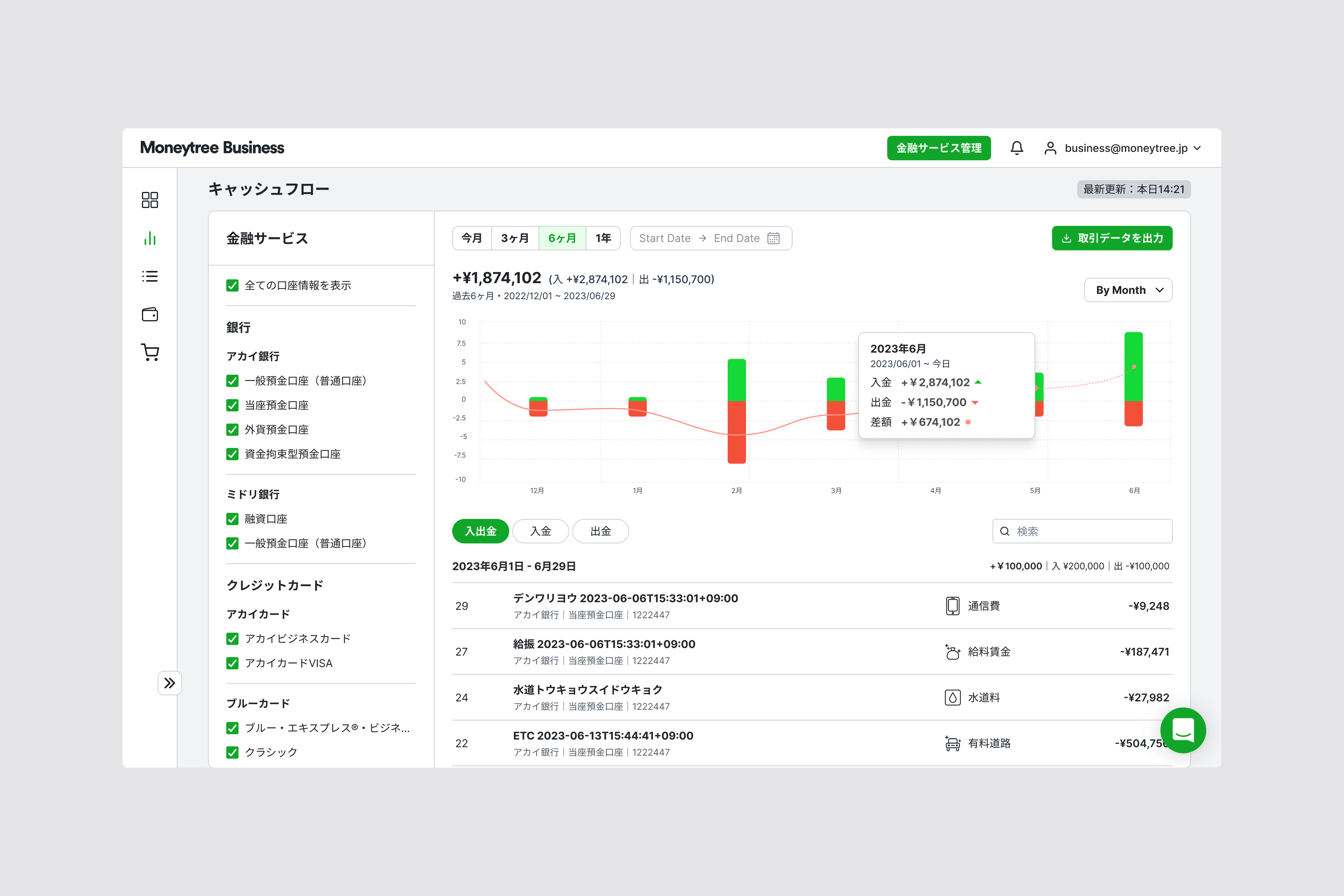

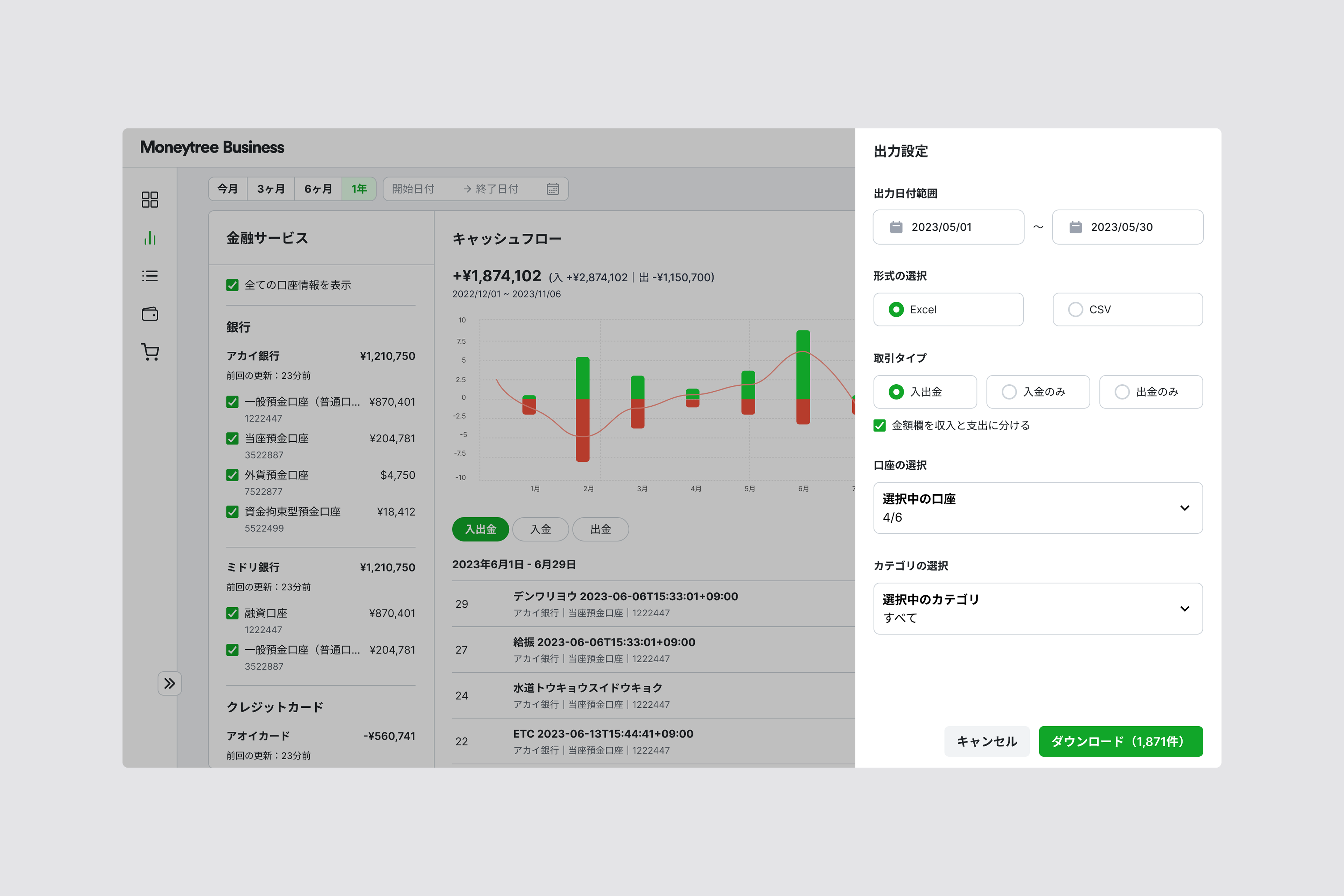

From these efforts we focused on addressing two core needs, monitoring cashflow and preparing clean data for accountants.

We built relationships with early adopters from industries like heavy machinery and import goods, iterating constantly based on their real-world feedback.

This direct connection revealed exactly what overwhelmed business owners needed most. Practical solutions to daily frustrations, not hypothetical feature requests.

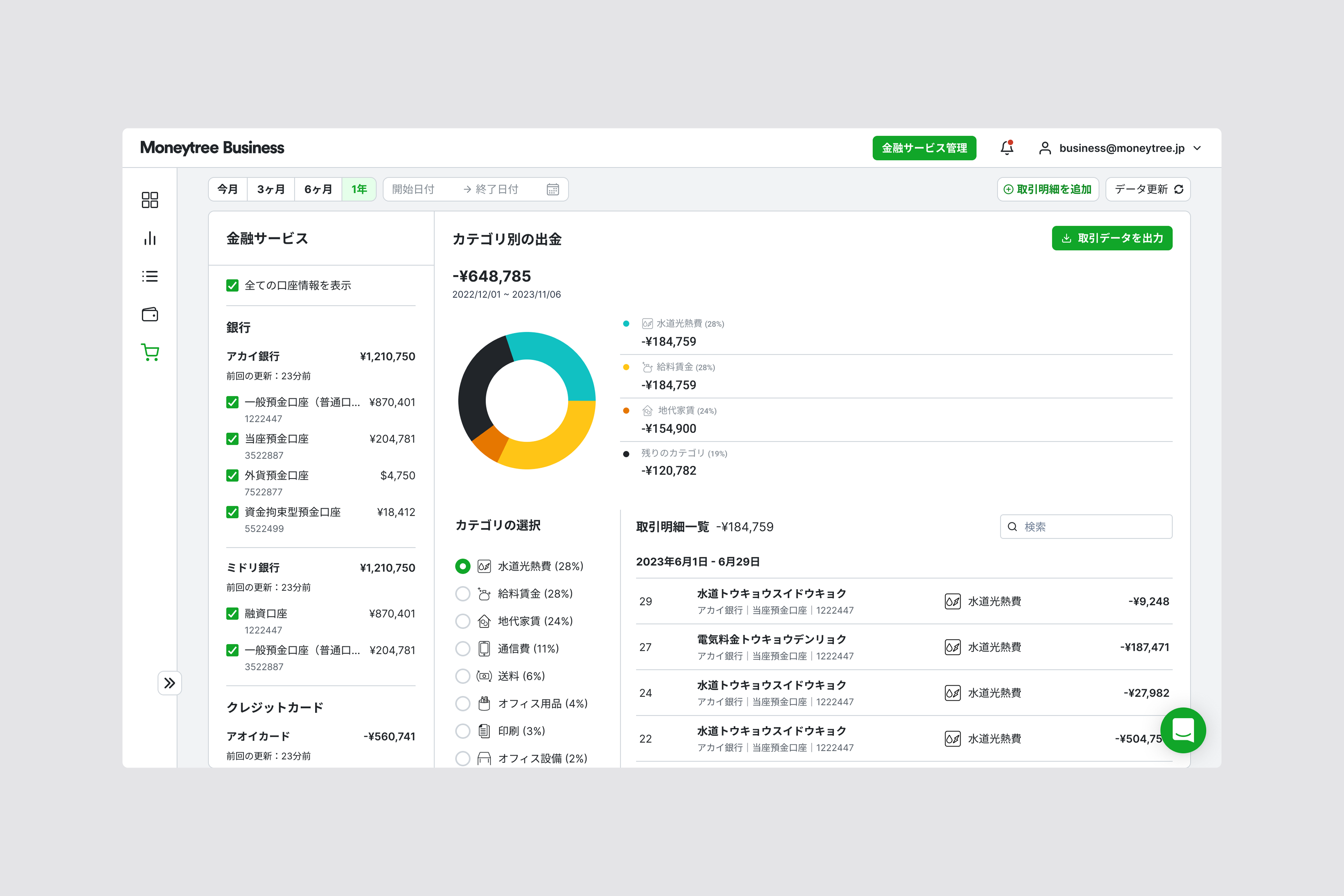

The secondary opportunity was categorization. By repurposing Moneytree's machine learning technology, we revealed spending patterns that business owners had never seen from their banks or accountants.

These insights helped them spot opportunities for cost reduction and confidently plan for new hires based on actual financial trends.

The product reached ¥2M ARR within months of launch, coming close to surpassing previous attempts at small business products. An aggressive but iterative go-to-market approach drove this growth, which centered around four strategies.

Before the product existed we created a web page to capture leads and generate ongoing interest. We identified self-employed users and small business owners from our 5 million plus user base, converting them through targeted email campaigns.

We also partnered with accounting and small business associations, attending their meetings to demo the product directly. Lastly, after every product update (every two weeks), we would release a new blog post explaining how these updates would make a difference to business owners. For if we weren't excited about the product evolving, why would a potential customer be?

I'm proud to say that when MUFG Bank, Ltd. acquired Moneytree in 2025, they specifically cited Moneytree Business' growth as one of the reasons they were confident and excited about the purchase.

Design Rubric

When I returned to Moneytree as Design Director, one of the most critical undertakings was establishing the company's first design evaluation rubric.

No rubric had existed prior, so without a shared language for evaluation, designers were left to navigate their growth independently. This regrettably resulted in many becoming disillusioned with no clear path forward.

Before implementation, I had the rubric peer-reviewed by the existing design team, leadership, and cross-functional partners. This ensured my team understood its purpose and application, but more importantly, it helped our cross-functional partners understand design's role and responsibilities within the organization.

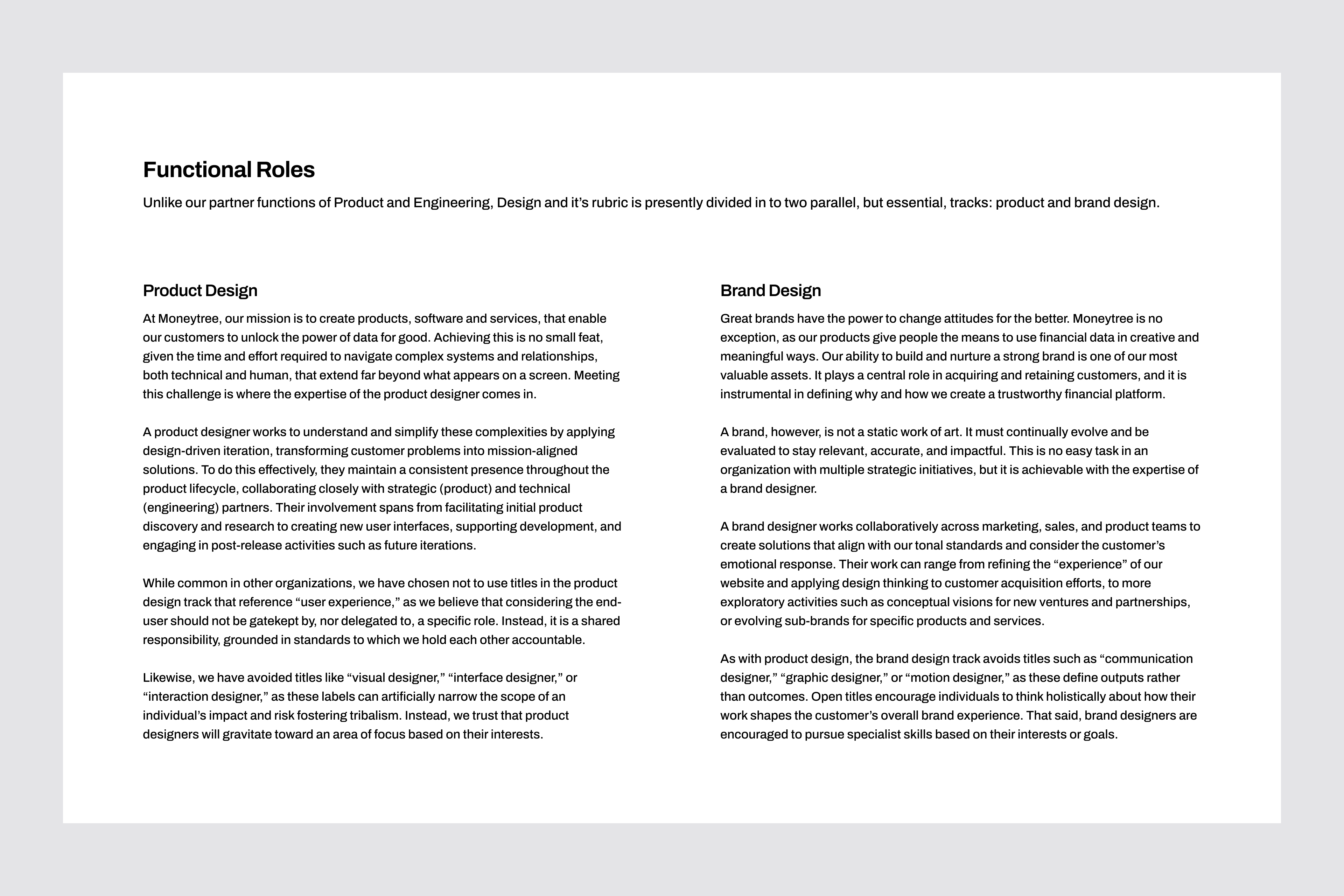

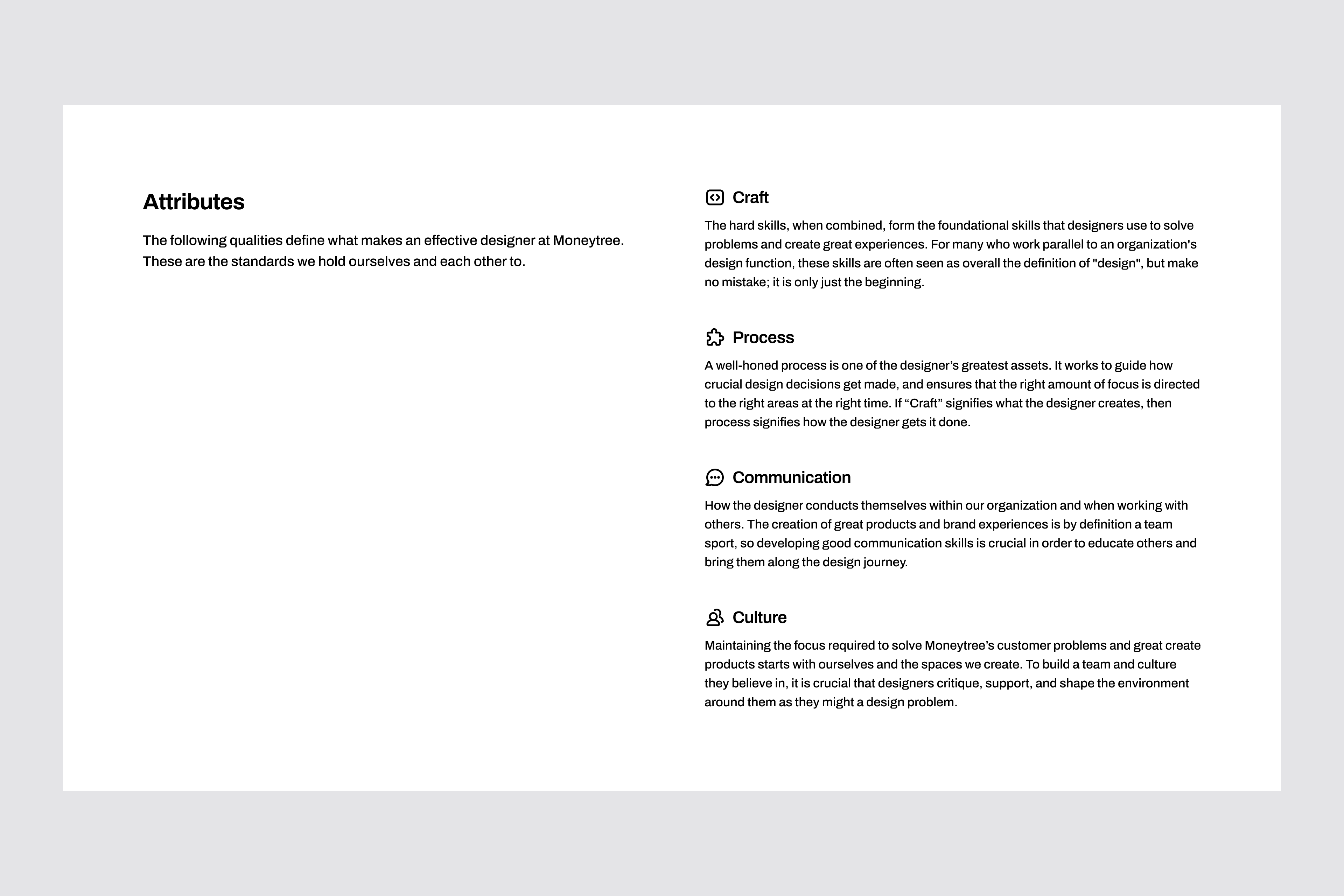

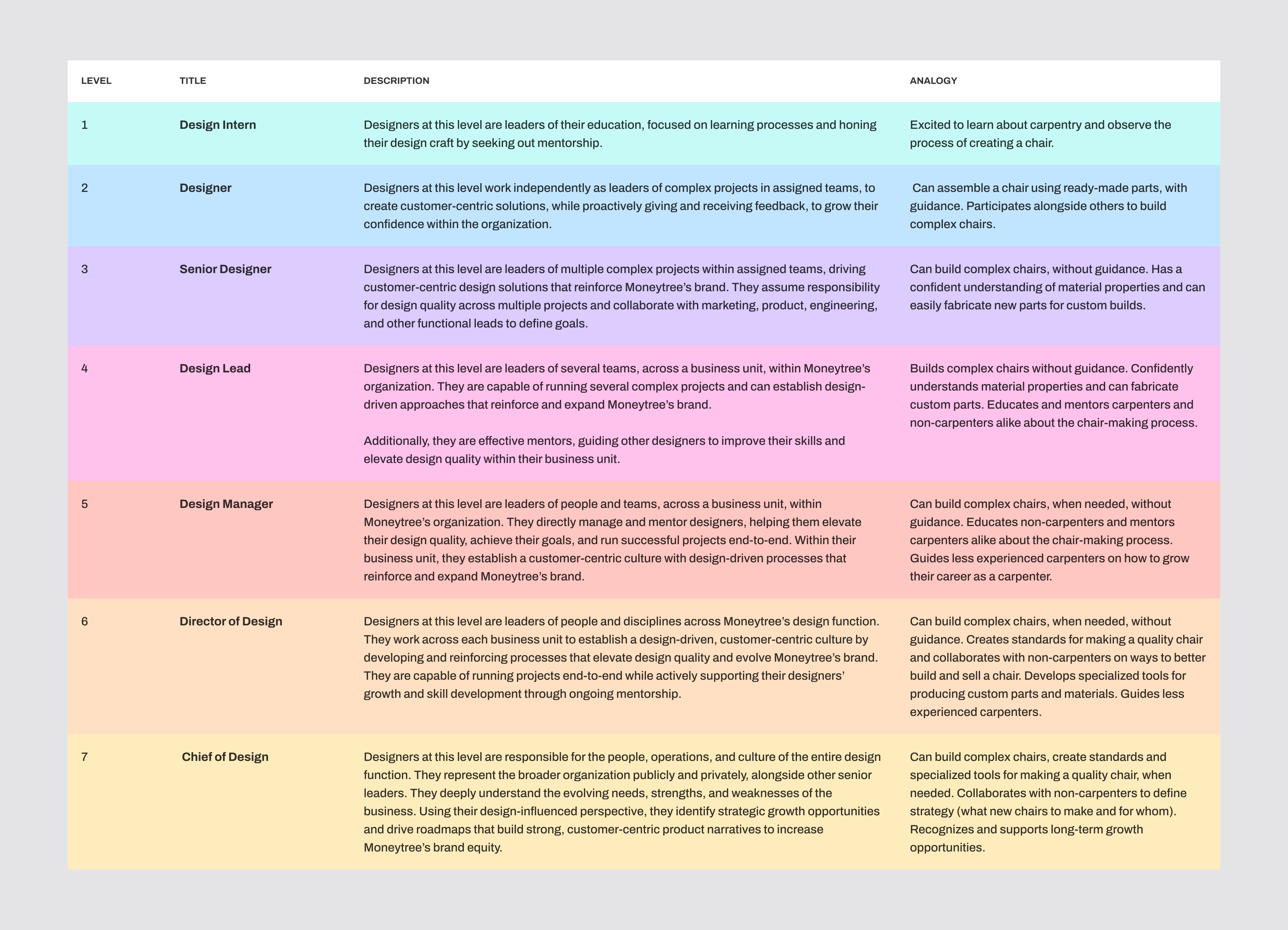

The rubric's structure was intentionally designed around three critical artifacts to address the most pressing challenges facing designers at Moneytree.

Attributes created a shared vocabulary for great design through Craft, Process, Communication, and Culture. Moving from subjective assessments to observable behaviors.

Levels solved growth visibility issues. However, the impact came from the use of analogies, using simplified metaphors to make each level immediately clear (later adopted by other functions).

Roles addressed confusion about what designers did. By defining Product and Brand Design tracks, we helped the organization understand design's strategic value rather than seeing it as a service.

Moneytree LINK

Moneytree LINK was one of Japan's first Open Banking platforms, setting the blueprint for financial data legislation in the country and enabling secure financial connectivity for millions of users. Think Plaid, but built specifically for Japan's unique financial ecosystem.

We provided data aggregation services and sharing infrastructure that allowed fintech startups, lending companies, insurance firms, and major institutions to offer seamless financial experiences. Some of our partners included MUFG, Mizuho, SMBC, AMEX, and Norton.

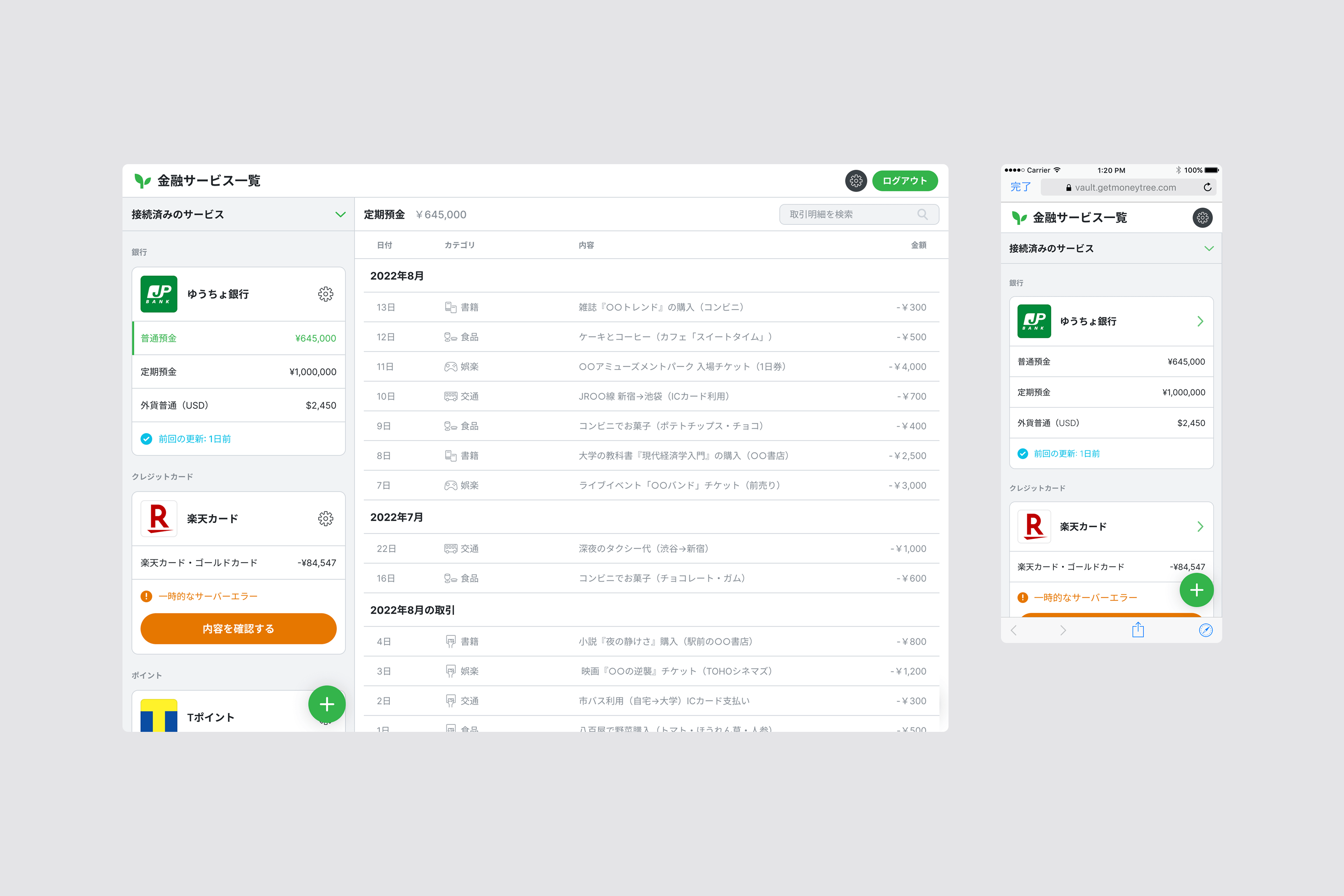

Moneytree ID

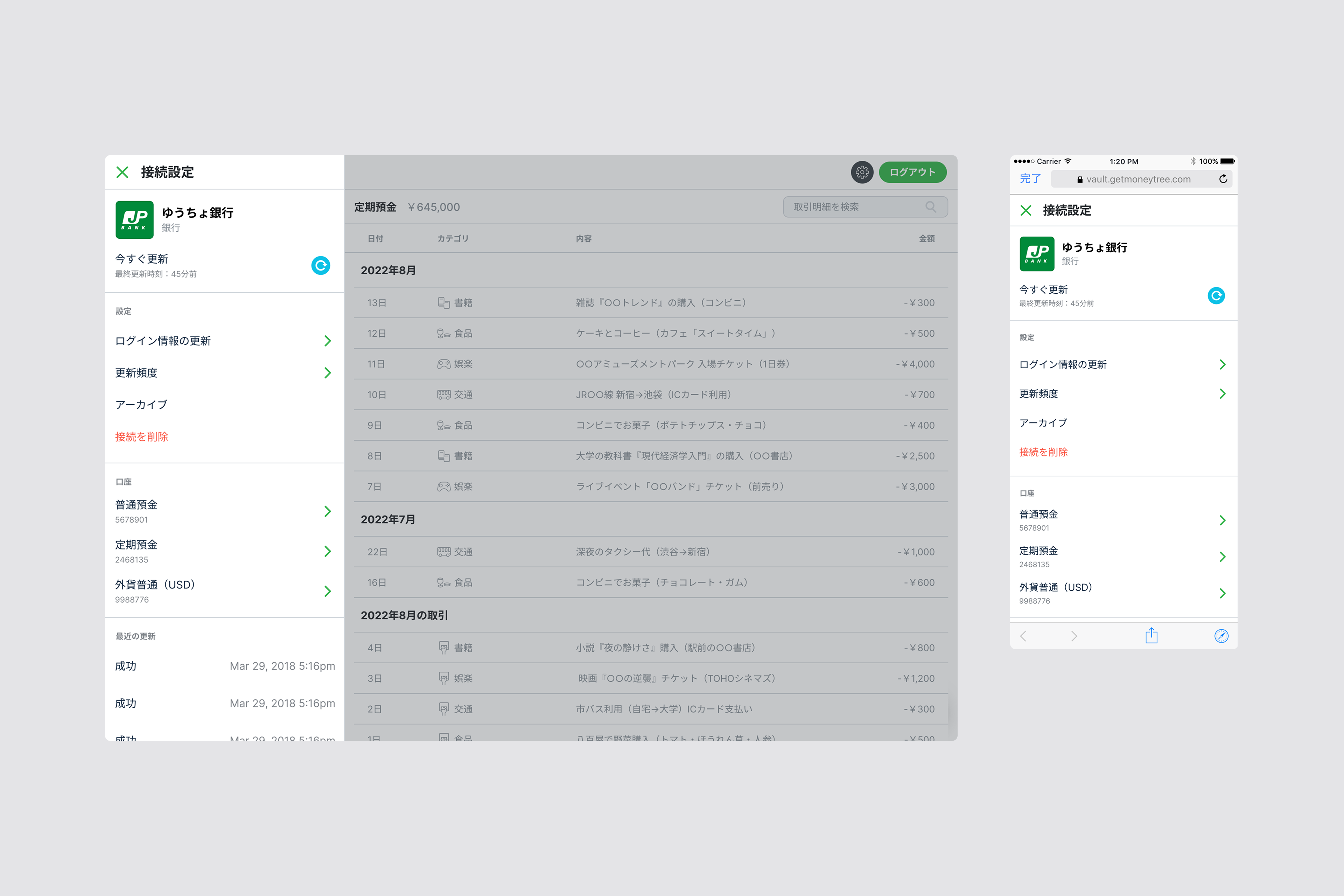

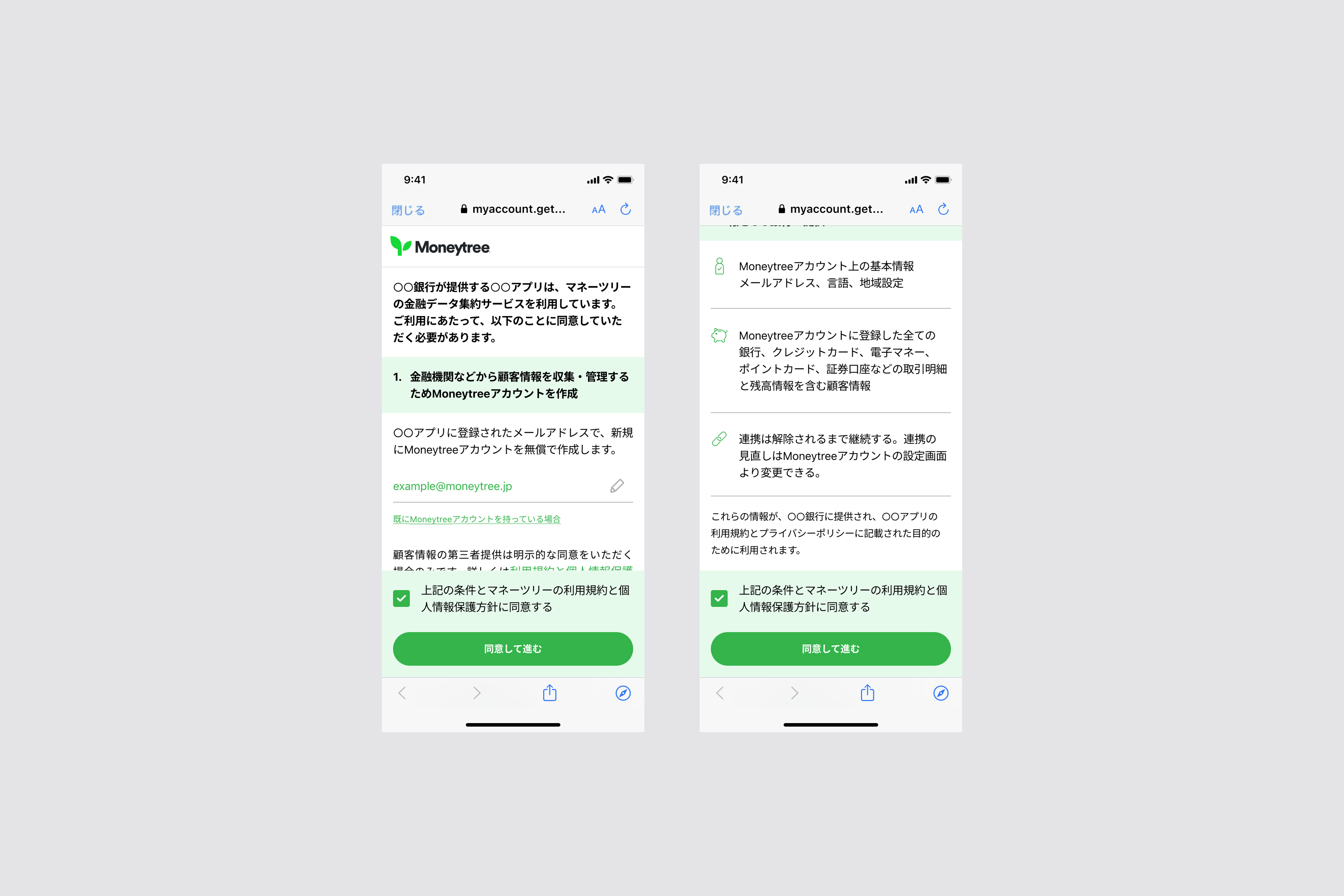

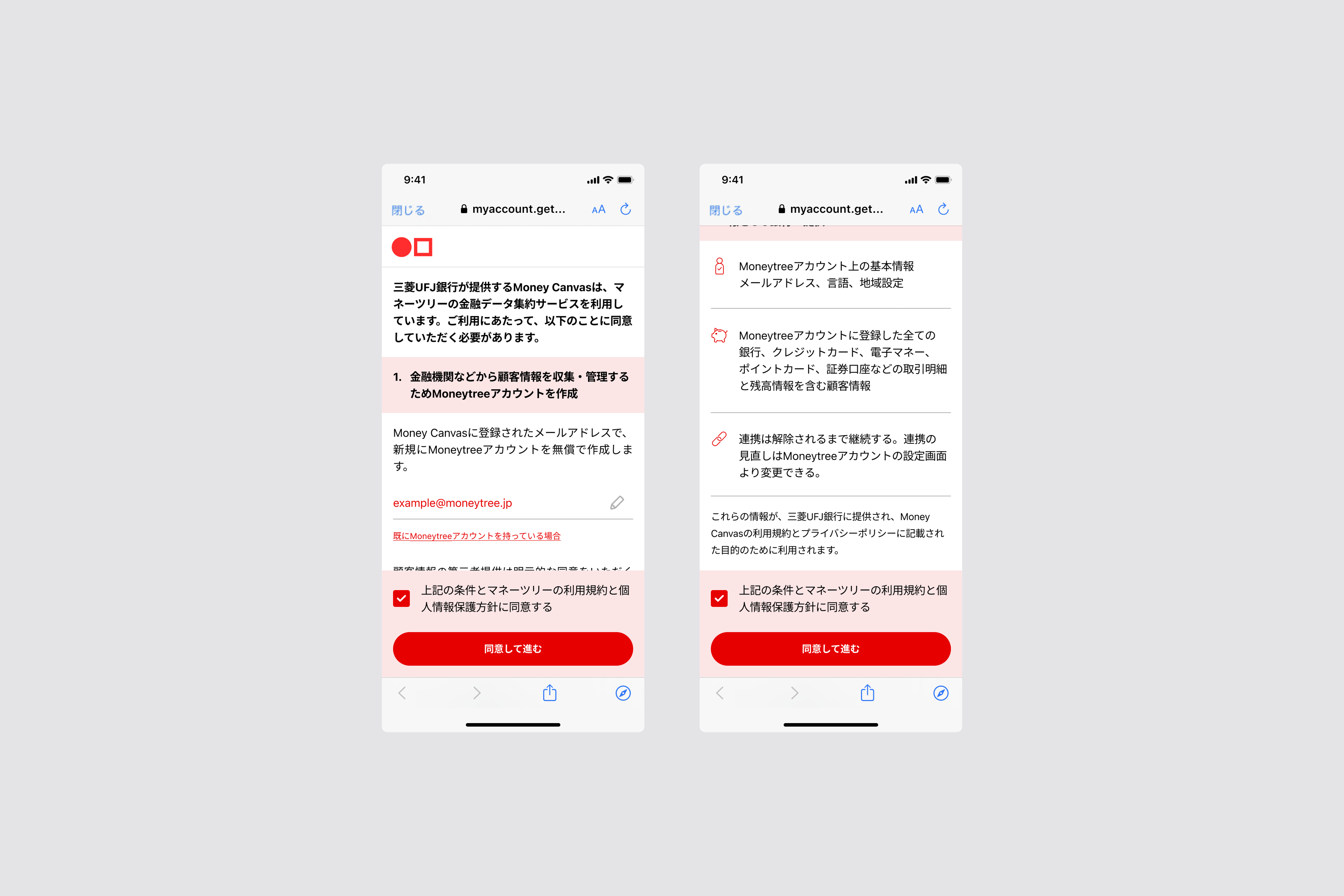

Moneytree ID gave users never-before-seen control over their financial data. Instead of manually entering bank details across multiple apps, people could securely connect their accounts once.

Users could decide exactly what information to share with each service, transforming fragmented financial experiences into seamless, integrated services.

To meet enterprise customer requirements while building trust with end users, we also created extensive customization options. These included custom colors, logos, and text, as well as control over which financial institutions and accounts could be added, allowing major institutions to maintain their brand identity.

Isshou Tsucho

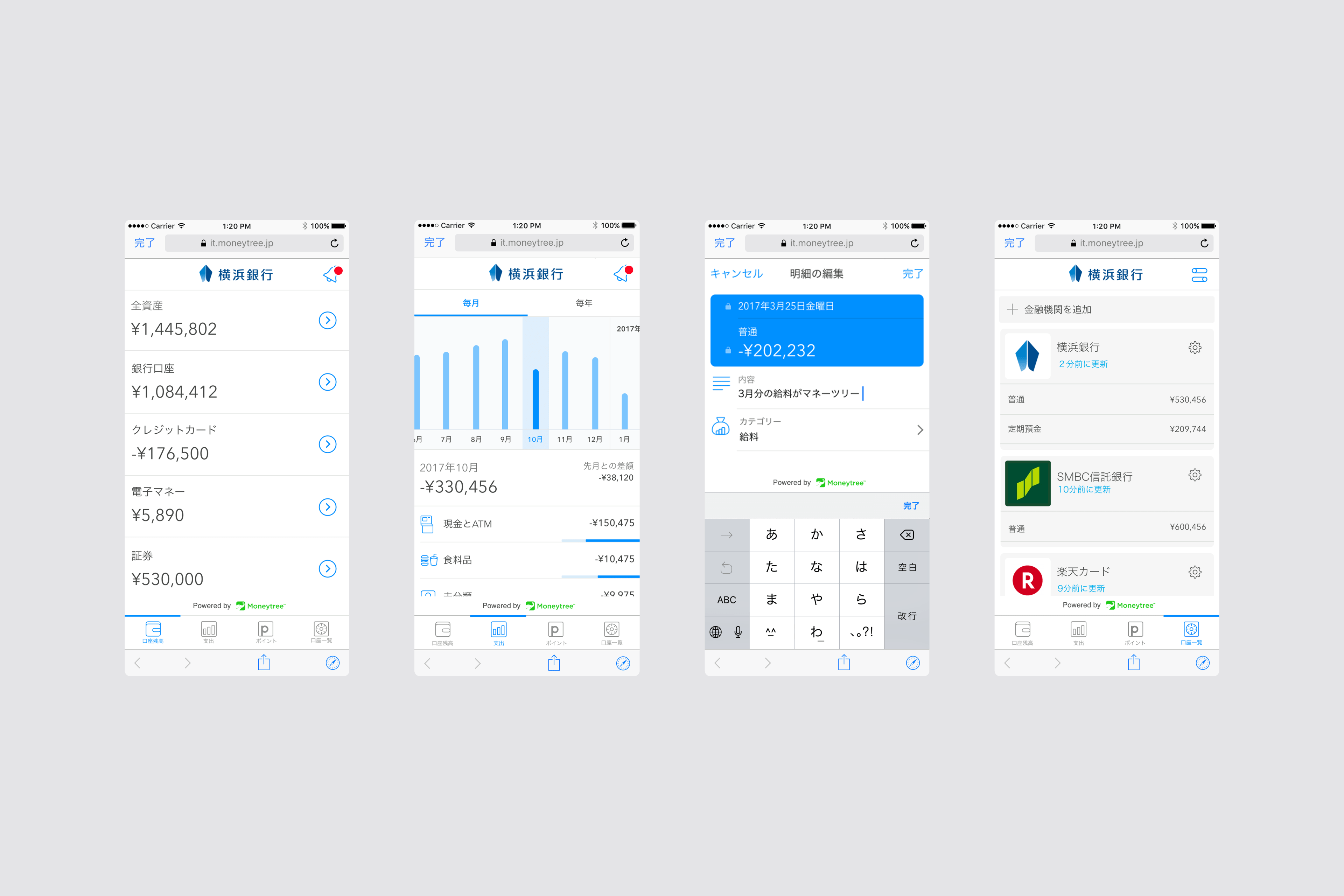

Before Moneytree LINK became our flagship strategy, we created white-label banking solutions for regional banks in Japan. The "Lifetime Bankbook" addressed a critical challenge for regional banks. They were losing customers to national competitors with superior digital offerings.

Working with Bank of Yokohama as our first customer, I designed mobile banking experiences that gave regional bank customers the digital capabilities they expected, like transaction history, and spending insights, through interfaces that maintained each bank's familiar identity.

The success led to partnerships with 25 regional banks and eventually caught the attention of Japan's major national banks, validating our white-label approach and setting the foundation for Moneytree LINK.